What car insurance cover is the cheapest?

Car insurance is a fundamental part of responsible vehicle ownership, ensuring that you are financially protected in the event of an accident, theft, or damage. But with so many options available, choosing the right coverage can be a challenge, especially when trying to find a balance between affordability and sufficient protection.

In this blog, we’ll focus on answering the key question: What car insurance cover is the cheapest? We’ll break down the various types of coverage and the factors that influence cost—so you can find the most cost-effective option without sacrificing the protection you need.

It’s important to understand that car insurance costs can vary dramatically depending on the type of coverage you choose, your personal driver profile (such as age, driving history, and credit score), and even your location. Whether you’re looking for basic liability coverage or comprehensive protection, there are affordable options out there—but finding the right one requires a closer look at the details.

Types of Car Insurance Coverage and Their Costs

When it comes to car insurance, not all policies are created equal. There are two main types of coverage to consider: Minimum Liability Coverage and Full Coverage. Each offers a different level of protection—and as you might expect, the cost will vary accordingly.

Minimum Liability Coverage

Minimum liability coverage is the most basic and often the cheapest type of car insurance. This coverage meets the minimum legal requirements in most states and covers damages and injuries you cause to others in an accident. However, it does not cover any damage to your own vehicle or medical costs for injuries you sustain.

While it is the most affordable option, it’s also the most limited in terms of protection. If you’re looking for the lowest possible premiums, minimum liability is the way to go—but keep in mind, you may be left with out-of-pocket expenses if you’re involved in an accident or your car is damaged.

Full Coverage

Full coverage is a more comprehensive option that includes liability coverage (for damages to others), collision coverage (for damage to your own car in an accident), and comprehensive coverage (for non-collision-related incidents, like theft or natural disasters). While this type of coverage is more expensive, it offers peace of mind knowing you’re protected in a wider range of scenarios.

Full coverage is ideal for drivers who want more extensive protection, especially if they drive a newer or more valuable car. However, because it covers more situations, you can expect to pay higher premiums compared to minimum liability coverage.

Cheapest Car Insurance Companies for Different Coverage Types

When it comes to finding the most affordable car insurance, not all providers offer the same rates. Costs can vary significantly depending on the type of coverage you choose and your personal circumstances. Let’s break down the cheapest providers for both minimum liability and full coverage options.

Minimum Liability Coverage

For those seeking the most affordable car insurance for minimum liability coverage, here are some of the top national and regional players:

- GEICO offers the cheapest national rates for minimum liability coverage, averaging about $41 per month. GEICO is known for its competitive pricing and wide availability across the U.S.

- USAA provides even lower rates for eligible members (military personnel and their families), with minimum coverage starting around $38 per month. However, USAA is not available to the general public.

- CSAA stands out in California, where rates can be as low as $14 per month. If you live in California, CSAA could be one of the most affordable options for liability-only coverage.

- Regional insurers like Auto-Owners and Erie also offer competitive rates for minimum liability coverage, though availability is limited to specific states.

Full Coverage

If you’re looking for full coverage, which provides more extensive protection, here are some of the most affordable options:

- Travelers offers some of the best rates for full coverage, averaging $146 per month nationally. It’s a strong contender for those who want a balance of cost and coverage.

- In California, CSAA again offers competitive full coverage rates, around $41 per month. If you’re in California, this is a great option to consider for more comprehensive protection.

- USAA continues to provide affordable rates for full coverage, especially for military members, with an average of $135 per month.

- Other national providers like Progressive, Erie, and GEICO also offer full coverage options, with rates generally ranging from $135 to $168 per month depending on your location and driving profile.

Cheapest Car Insurance by Driver Profile

Car insurance rates aren’t one-size-fits-all. Depending on your age, driving record, credit history, and other personal factors, your premium can vary significantly. Here’s a breakdown of the cheapest options available for different driver profiles:

Young Drivers

For younger drivers—often seen as higher-risk due to lack of experience—insurance rates can be high. However, GEICO offers relatively affordable rates for young drivers, with premiums starting at around $81 per month. While still higher than other groups, this is one of the more budget-friendly options for new drivers.

Millennials

Millennials typically benefit from slightly lower rates than young drivers, but affordability still depends on the provider. GEICO again leads the pack, offering some of the lowest rates for this age group, starting at about $40 per month. This makes GEICO a strong choice for those in their 20s and early 30s who are looking for both affordability and good coverage.

Senior Drivers

Senior drivers can often find more affordable rates from insurers that specialize in coverage for older adults. GEICO and Shelter Insurance offer competitive rates for seniors. Shelter Insurance, in particular, is known for providing some of the cheapest minimum coverage for seniors, though availability may vary by location.

Drivers with Poor Credit

Drivers with poor credit often face higher premiums, but GEICO stands out as one of the most affordable options for this group. On average, GEICO offers rates as low as $57 per month for drivers with poor credit, making it a solid option for those looking to save.

Drivers with Violations

Your driving history plays a big role in determining your premium. If you’ve had a violation, here’s how some of the top insurers stack up:

- Speeding ticket: After a speeding ticket, State Farm offers some of the best rates, with premiums starting at around $53 per month.

- Accident: If you’ve had an accident, Travelers is known for offering affordable post-accident rates, averaging about $60 per month.

- DUI: After a DUI, premiums can skyrocket, but Progressive offers some of the lowest rates in this category, with premiums starting at $64 per month.

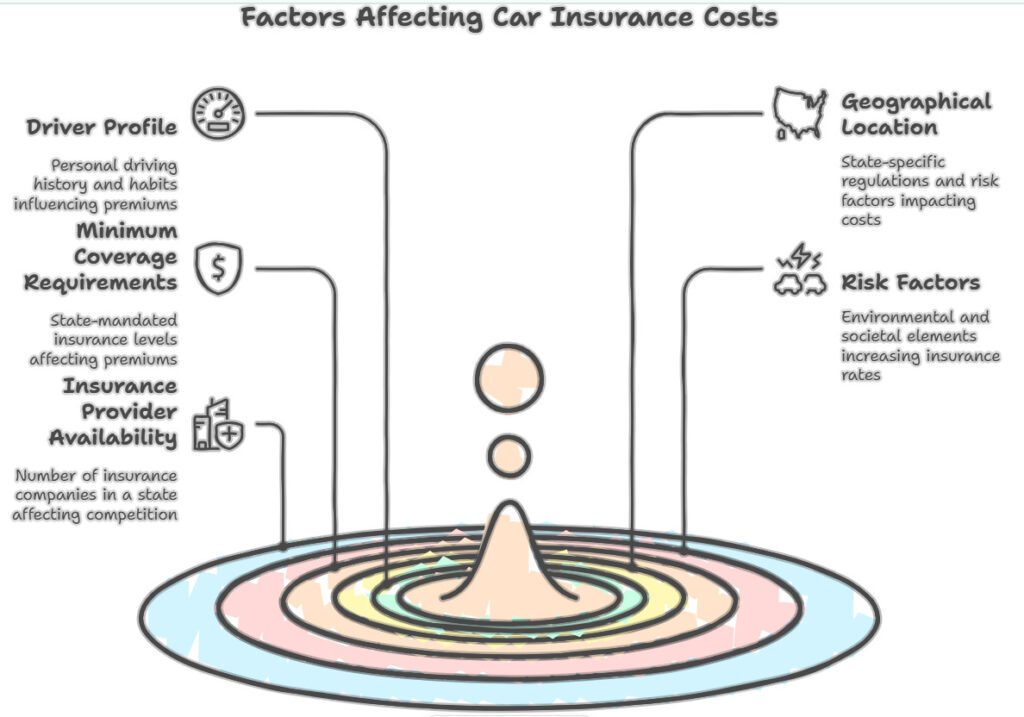

State and Regional Variations

Car insurance costs vary widely not only based on your driver profile but also based on where you live. States have different minimum coverage requirements, risk factors, and even insurance providers available, which can all affect the cost of your premium.

California Example

In states like California, where insurance costs can be high due to dense traffic, high accident rates, and expensive repair costs, insurers like CSAA (California State Automobile Association) stand out as offering significantly lower rates. For example, CSAA offers minimum coverage for as low as $14 per month and full coverage for about $41 per month. This makes it a great option for drivers in the Golden State, especially considering how expensive car insurance can be in urban areas like Los Angeles or San Francisco.

Regional Insurers

Aside from national providers, regional insurers like Erie and Auto-Owners can also offer more affordable rates, but their availability is typically limited to specific states. Erie offers competitive rates in regions like the Midwest and Northeast, while Auto-Owners is particularly affordable in the Southeast.

Assessing Availability by State

It’s crucial to assess which insurers are available in your state before making a decision. You can do this by requesting quotes from multiple providers or using online comparison tools. Be sure to check the regional options in your area, as sometimes they can offer better rates than the big national names.

Summary Table of Average Monthly Rates

To make it easier to compare the options we’ve discussed, here’s a concise table showing the average monthly rates for both minimum and full coverage from national and regional insurers:

| Company | Minimum Coverage (Avg. $/month) | Full Coverage (Avg. $/month) |

|---|---|---|

| GEICO | $41 | $165 |

| USAA* | $38 | $135 |

| Travelers | $55 | $161 |

| Progressive | $61 | $211 |

| State Farm | $59 | $220 |

| Erie (Regional) | $44 | $168 |

| Auto-Owners (Regional) | $41 | $167 |

| CSAA (California) | $14 (minimum CA) | $41 (full CA) |

*USAA is available only to military members and their families.

Key Takeaways

- Minimum liability coverage is the cheapest option, but it offers limited protection. It’s ideal for those on a budget or with older vehicles.

- GEICO is often the most affordable option for minimum coverage, especially among large national insurers.

- If you’re looking for full coverage, Travelers and CSAA (in California) offer the best rates.

- Regional insurers like Erie and Auto-Owners can provide competitive rates depending on where you live.

- Your age, driving record, credit score, and state of residence play a major role in determining the best deal for you. Always shop around and compare quotes to ensure you’re getting the best possible rate.

Conclusion

Choosing the right car insurance coverage is essential for protecting yourself and your vehicle, but it’s just as important to find a policy that fits your budget. By understanding the different types of coverage, the cheapest providers, and how your personal profile and location affect costs, you can make an informed decision.