What Is the Best Funding for a Business? A Complete Guide to Choosing Wisely

Whether you’re launching a disruptive app or scaling a local bakery, funding is the fuel that keeps your business engine running. But with dozens of options on the table—from personal savings to venture capital—it’s easy to feel overwhelmed.

The truth? There’s no “best” funding in a vacuum. The right choice hinges on your business’s stage, scale, and what you’re willing to trade off—control, ownership, or growth speed.

This blog unpacks the full funding spectrum. We’ll break down the options, spotlight the pros and cons, and help you match the right funding path to your specific business type and goals. Let’s demystify the money.

What to Consider Before Choosing Funding

Before you chase capital, pause and reflect. Funding isn’t just about getting cash—it’s about strategic alignment. Here are the key questions to ask:

Control vs. Ownership

Are you okay giving up a slice of your business for outside investment? Or do you want to call all the shots, even if it means slower growth?

Debt vs. Equity

Would you rather take a loan and repay it with interest (debt), or offer investors a piece of your company in exchange for cash (equity)?

Stage of Business

Funding needs look different at every phase—pre-launch, post-revenue, or scaling internationally. Identify where you are and what’s realistic.

Amount & Urgency

Do you need £5,000 next week—or £500,000 over the next year? Timing and size matter more than you think.

Strategic Extras

Some funding comes with mentorship, industry connections, or credibility boosts. Do you need just money—or smart money?

Your answers to these questions will narrow the field—and help you spot the funding that fits, not just funds.

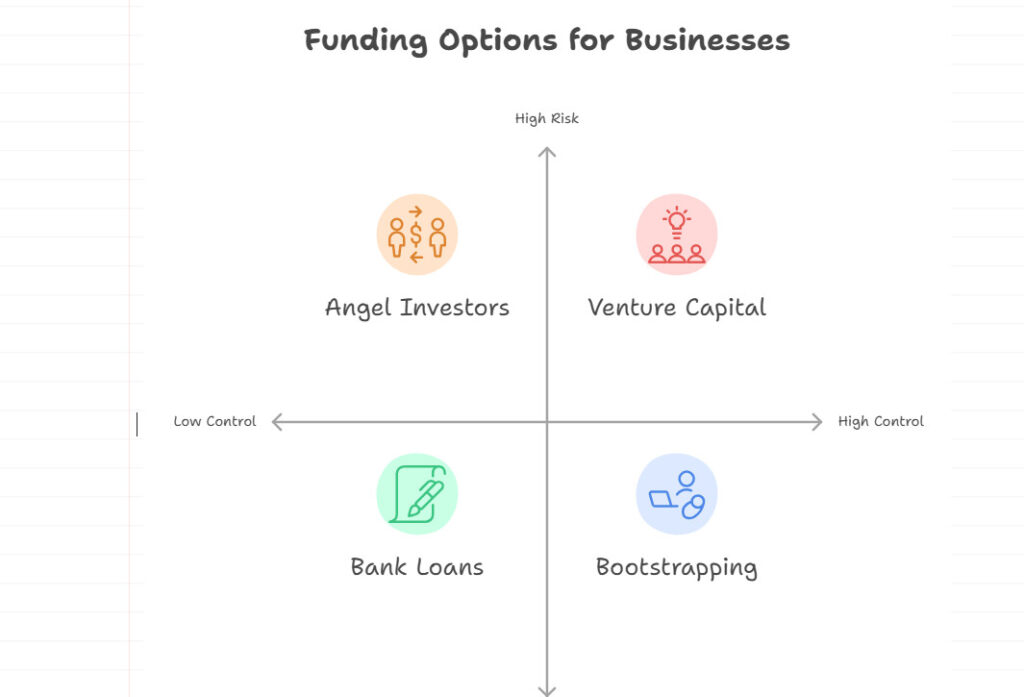

Funding Options Breakdown

Let’s dive into the full menu. Each option includes what it is, the trade-offs, when to consider it, and a real-world example for context.

Self-Funding (Bootstrapping)

What it is:

Using your own savings or early business revenue to fund operations.

Pros and Cons:

✅ Full control, no equity loss

❌ Limited funds, personal financial risk

Best for:

Early-stage startups with modest capital needs and a founder who wants to stay in the driver’s seat.

Example:

Basecamp bootstrapped from the ground up, staying profitable without outside funding.

Government Grants and Programs

What it is:

Non-repayable funds awarded for innovation, development, or specific social/economic goals.

Pros and Cons:

✅ No repayment, added credibility

❌ Highly competitive, strict eligibility

Best for:

R&D-heavy businesses or those in niche sectors (e.g. tech, sustainability, social impact).

Notable Programs:

SBIR, STTR, Cardiff Voucher Scheme.

Small Business Loans

What it is:

Borrowing from a bank or government scheme, repaid with interest on a fixed schedule.

Pros and Cons:

✅ Retain ownership, predictable repayments

❌ Requires strong credit and clear business plan

Best for:

Established businesses with revenue or a solid financial forecast.

Example:

Start Up Loans offer up to £25,000 with 6% interest and business mentoring

Angel Investors

What it is:

High-net-worth individuals investing personal capital for equity in early-stage startups.

Pros and Cons:

✅ Flexible terms, strategic guidance

❌ Smaller sums than VC, potential for conflict

Best for:

Founders looking for both cash and advice.

Example:

Chris Sacca was one of Uber’s earliest backers.

Venture Capital (VC)

What it is:

Institutional investors offering large sums in exchange for equity, aiming for high returns.

Pros and Cons:

✅ Massive funding, access to networks

❌ High pressure, significant equity loss

Best for:

Scalable startups targeting rapid, aggressive growth.

Example:

Airbnb raised early capital from Sequoia and Greylock to scale globally.

Crowdfunding

Types:

- Reward-based: Backers get a product/service.

- Equity-based: Backers get shares.

- Donation-based: Pure support, no returns.

Pros and Cons:

✅ Market validation, no equity loss (in some models)

❌ Time-consuming, no guaranteed funding

Best for:

Product-focused businesses with a strong brand story and online community.

Example:

Oculus Rift raised $2.4 million on Kickstarter pre-Facebook.

Alternative Financing Options

Options Include:

- Microfinancing: Small, quick loans

- Peer-to-Peer Lending: Borrow directly from individuals

- Family & Friends: Personal networks with informal terms

- Strategic Partnerships: Resource-sharing with aligned businesses

Pros and Cons:

✅ Fast and flexible options

❌ Risk of personal or reputational fallout

Best for:

Niche or early-stage needs, when traditional options fall short.

Decision-Making Matrix: How to Choose the Right Funding for You

Not sure where to start? Use this quick self-audit to narrow your focus.

- Are you okay with repayment pressure? → Consider loans or P2P lending.

- Willing to share ownership for guidance? → Look at angels or VCs.

- Need just a boost for a specific idea or product? → Crowdfunding could work.

- Is your business pre-revenue or idea-stage? → Grants or bootstrapping might be safer.

🟢 Green Lights: Clear growth plan, solid financials, strategic partners

🔴 Red Flags: Overfunding too early, unclear exit strategy, incompatible investor goals

Summary Table: Quick Comparison of All Options

| Funding Type | Pros | Cons | Best Suited For |

|---|---|---|---|

| Self-Funding | Full control, no repayment or equity loss | Limited capital, personal financial risk | Early-stage startups with lean models |

| Government Grants | No repayment, added credibility, support for innovation | Competitive, narrow eligibility, often small amounts | R&D-driven or impact-focused businesses |

| Small Business Loans | Ownership retention, fixed repayment, government-backed options | Requires good credit and financials, must repay regardless of outcome | Businesses with revenue or solid forecasts |

| Angel Investors | Strategic guidance, flexible terms, early-stage believers | Smaller amounts, equity trade-off, potential creative differences | Startups needing cash + mentorship |

| Venture Capital | Large funding, strong networks, industry expertise | Equity dilution, high-pressure growth targets | Scalable startups aiming for rapid growth |

| Crowdfunding | Validates market, builds community, minimal equity loss (reward model) | Time-intensive, uncertain outcomes, may not scale well | Product-based or community-driven businesses |

| Alt. Financing | Flexible, fast access, creative deal structures | Varies widely—personal risk, high interest, relationship dynamics | Specific, short-term or unconventional capital needs |

Final Thoughts

There’s no such thing as the best funding—only the best fit for your business.

Whether you’re in idea mode or scaling fast, the funding landscape is as diverse as the businesses it supports. The key is aligning the right strategy with your goals, appetite for risk, and long-term vision.

You now have the map. So, take your pick—bootstrap or borrow, pitch or post—and build with purpose.

📌 Bookmark this guide, share it with your founder friends, and circle back whenever your funding needs evolve.

7. References & Resources

Here are the trusted sources behind this guide, along with helpful platforms and tools:

🧠 Further Reading

- Start Up Loans: Business Funding Alternatives

- Vivacf: Funding Options for Small Businesses

- FasterCapital: Pros & Cons of Startup Funding

- Guidant Financial: Funding Questions to Ask

- SBA.gov: Fund Your Business

- Economic Development Collaborative: Alternative Options

- Lomit Patel: Business Funding Guide

- Forbes: Best Grant Websites

FAQ

What is the easiest way to fund a business when you’re just starting out?

Self-funding (bootstrapping) is usually the quickest route—using savings or early revenue to get going. It keeps you in control but may limit how fast you grow. Crowdfunding and small business loans can also be accessible, depending on your credit and audience.

Do I need a business plan to secure funding?

Yes—almost always. Whether you’re applying for a loan, pitching to an investor, or applying for a grant, a solid business plan is your ticket to being taken seriously. It should outline your vision, market, financials, and how the funding will be used.

What’s the difference between angel investors and venture capitalists?

Angel investors are typically individuals investing their own money in early-stage businesses, often bringing mentorship too. Venture capitalists are firms managing pooled funds, investing in high-growth startups with expectations of big returns—and usually more control.

Can I combine different funding sources?

Absolutely. In fact, it’s common to mix funding types—like bootstrapping early, then adding a loan or angel investment later. Just ensure you’re clear on the terms of each and how they impact ownership and repayment.

How do I know if I’m ready for outside funding?

Ask yourself: Do you have a clear plan, a realistic valuation, and a growth strategy? Are you comfortable sharing control or taking on debt? If yes, you may be ready. If not, build a stronger foundation before seeking outside capital.